Start your AML Process with something simple - name checking. We’ve made it even more simple with UCheck.

Covered Persons are mandated to report all covered and suspicious transactions to the Anti-Money Laundering Council (AMLC).

Covered Persons are mandated to report all covered and suspicious transactions to the Anti-Money Laundering Council (AMLC).

Check if your industry is covered by AMLC;

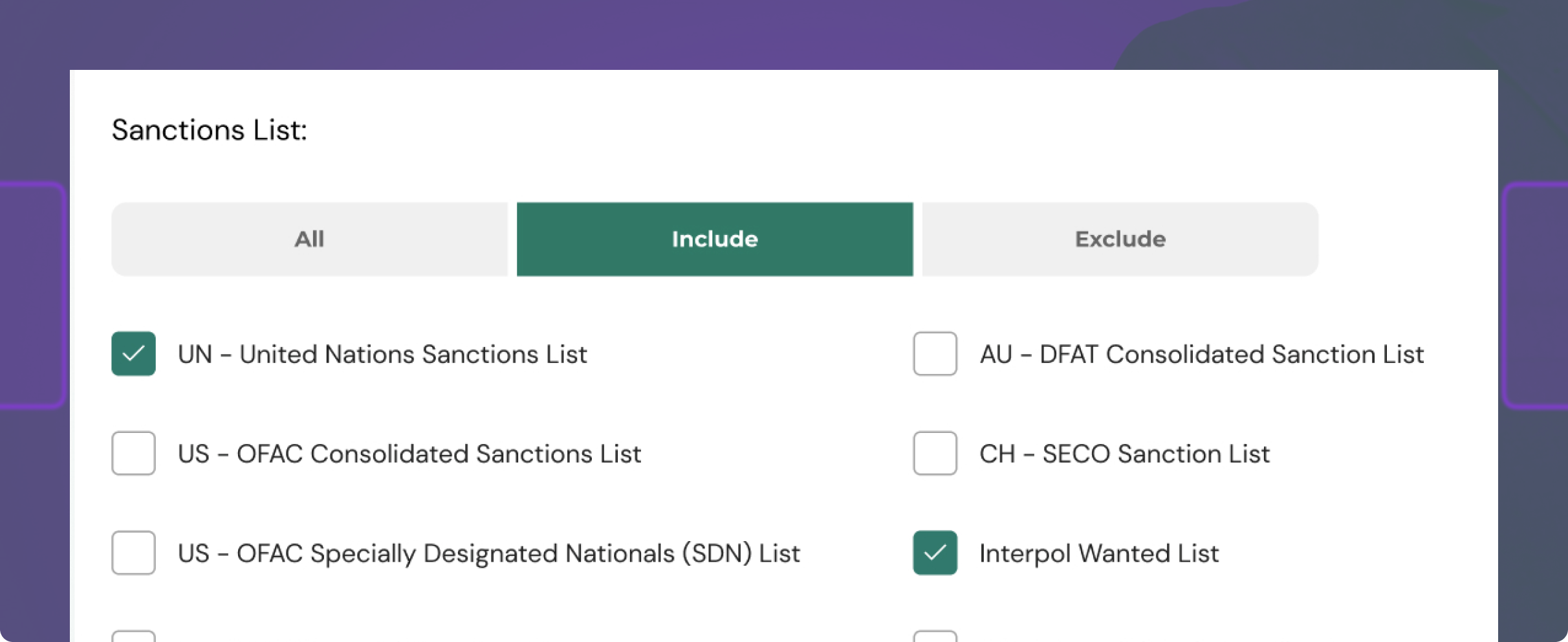

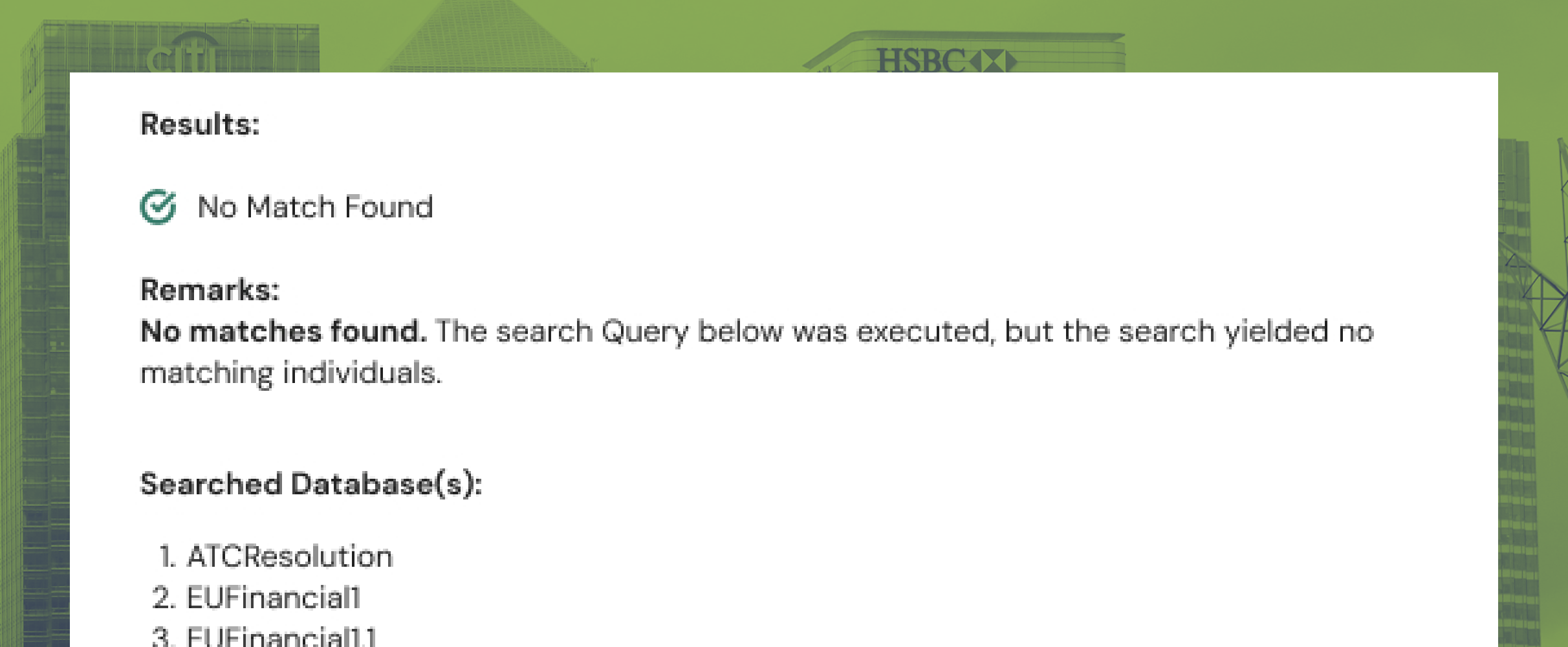

Conduct sanctions list screening and PEP Checks

Use UFR to sign your documents more securely.

Search for Adverse Media

Choose between an e-signature or a digital signature, or have both!

Submit reports to the AMLC

Simply upload your documents (pdf, doc, docx, even .png/.jpg, we don’t judge) and sign, sign, sign!

The following are the databases and repositories being constantly searched by UCheck: United Nations Security Council (UNSC) Consolidated List, UN Al-Qaida Sanctions List, Office of Foreign Assets Control, Anti-Terrorism Council (ATC) Resolutions

UNAWA's solutions seamlessly adapt to a range of sectors — from banking and finance to legal, real estate, local government, and healthcare.

.accordion-body, though the transition does limit overflow.

.accordion-body, though the transition does limit overflow.

.accordion-body, though the transition does limit overflow.