FinTech’s rapid rise in the Philippines is transforming how you do business, offering unmatched convenience and innovation. However, these advancements also bring new challenges, especially in a country where digital adoption is soaring, but regulatory frameworks, like the Anti-Money Laundering Act (AMLA) or Republic Act No. 9160, are still catching up.

From virtual currencies to digital platforms like social media and crowdsourcing, your business could face emerging threats that pose risks to compliance with local regulations and AMLA guidelines.

FinTech is revolutionizing how financial services are delivered, bringing unmatched convenience to businesses like yours. From digital wallets to mobile banking, FinTech platforms make financial services more accessible, especially in remote areas of the Philippines where traditional banking infrastructure is limited.

However, this wave of innovation also introduces new risks that require careful attention and robust security measures.

One key feature of FinTech is non-face-to-face onboarding, which allows customers to open accounts and access services without ever needing to visit a physical location. While this makes banking more accessible, it also provides opportunities for bad actors to exploit these systems with fake identities or fraudulent accounts.

Similarly, many FinTech firms operate online without physical branches, reducing costs and limiting traditional oversight mechanisms that help prevent fraud and other financial crimes.

Additionally, FinTech uses cutting-edge technology for quick access to services and digital identity verification, such as KYC (Know Your Customer) processes, to speed up customer onboarding. Yet, if these digital verification methods are not foolproof or adequately secure, they can increase the risk of fraud.

RELATED: FinTech in the Philippines – Statistics & Facts

The features that make FinTech appealing — like speed, convenience, and accessibility — also create opportunities for illicit activities. Let’s break down how these features can pose significant risks:

One key advantage of FinTech platforms is the ability tocreate bank accounts online without ever stepping into a physical branch. This convenience is a boon for customers who want quick access to financial services, especially in a country like the Philippines, where banking penetration is still growing.

However, this same feature also makes it easier for criminals to create multiple accounts using fake or stolen identities, bypassing the traditional checks and balances that physical branches provide. During the initial stage of money laundering, known as “placement,” these anonymous accounts can be used to deposit illicit funds into the financial system.

For instance, the ease of anonymizing multiple accounts can be exploited to funnel illegal money through various channels, making it harder for authorities to trace the origin of the funds. This highlights the need for FinTech companies to enhance their identity verification processes to prevent abuse.

FinTech platforms provide rapid transaction processing, which is a great advantage for businesses and consumers who value speed and efficiency. However, this speed can also be a double-edged sword when it comes to financial crimes. In the “layering” stage of money laundering, criminals aim to obscure the origins of their money by moving it through multiple transactions and accounts as quickly as possible.

The rapid nature of digital transactions allows illicit funds to be transferred between accounts, converted into different currencies, or even funneled through virtual currencies in a matter of seconds. This makes it exceedingly difficult for financial institutions and regulators to track and freeze assets in time.

With its growing FinTech ecosystem, the Philippines must be particularly vigilant about these rapid transactions that can quickly go unnoticed if not properly monitored.

Unlike traditional banks, FinTech platforms often operate with less stringent regulatory oversight, which can create significant opportunities for money laundering. In the Philippines, this lack of oversight has become particularly concerning with the rise of online gambling platforms like POGOs (Philippine Offshore Gaming Operators). These platforms have been criticized for their weak adherence to AML laws, making them potential hotbeds for money laundering activities.

For example, recent controversies have highlighted the involvement of figures like former Mayor Alice Guo, who has been accused of facilitating POGO operations despite the potential risks they pose.

RELATED: Alice Guo’s Controversies: From Senate POGO Probe to Her Escape

The lack of stringent regulatory scrutiny allowed these platforms to conduct quick and easy financial transactions, providing an ideal environment for criminals to “integrate” illicit funds back into the financial system. This scenario underscores the need for businesses involved in FinTech to be particularly vigilant, ensuring they have robust AML processes to mitigate these emerging risks.

Strengthening internal controls and enhancing regulatory compliance can help prevent businesses from becoming unwitting conduits for money laundering activities.

In the battle against financial crime, Regulatory Technology (RegTech) is proving essential for FinTech businesses. These tools are designed to detect and prevent illegal activities, helping companies comply with evolving regulations. Key RegTech solutions include:

Customer Profiling: Advanced tools like biometric checks, OCR (Optical Character Recognition), and ID validation ensure accurate customer identification, reducing the risk of fraud.

Transaction Monitoring and Risk Scoring: Real-time monitoring systems and risk scoring algorithms help flag suspicious transactions, enabling quick intervention to prevent money laundering.

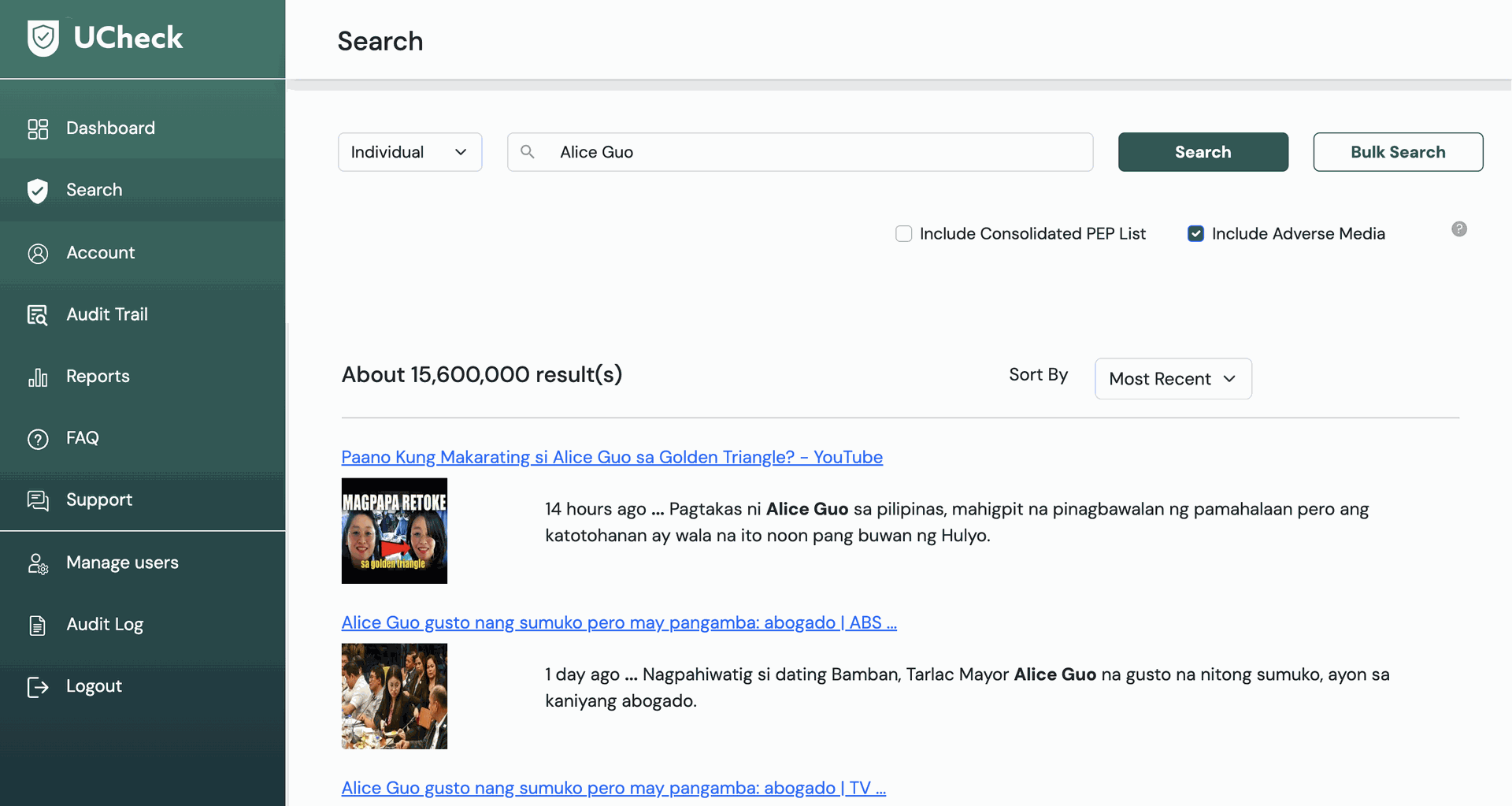

Sanction Screening and Predictive Analysis: Automated tools perform PEP (Politically Exposed Person) checks, adverse media screening, and predictive analysis to identify and mitigate risks before they escalate.

By adopting RegTech solutions such as UCheck, businesses can bolster their AML defenses, ensure compliance, and safeguard their operations against emerging threats.

RELATED: How UCheck Solves the Biggest Challenges in AML Compliance

As FinTech continues to transform the financial landscape, businesses must remain vigilant and proactive in addressing emerging risks. The digital-first world demands a robust approach to compliance, leveraging the latest technologies to stay ahead. Is your business ready to navigate the complexities of this evolving environment and protect itself from potential vulnerabilities?