The fight against money laundering and terrorism financing is a global effort, and in the Philippines, it's a critical aspect of financial governance. TheAnti-Money Laundering Act (AMLA) of 2001 (Republic Act No. 9160, or RA 9160) sets the foundation for anti-money laundering (AML) efforts in the country. Under this law, financial institutions are required to implement stringent measures to detect and report suspicious activities. The Anti-Money Laundering Council (AMLC) plays a pivotal role in ensuring compliance and enforcing regulations through its online portal.

One of the most crucial stages in preventing financial crimes is during the client onboarding process. This is when institutions have the opportunity to identify potential red flags that may indicate money laundering or terrorism financing. In this post, we will discuss the red flags to watch out for during the onboarding process and how Philippine financial institutions can strengthen their AML/CFT (Combating the Financing of Terrorism) strategies.

Understanding Red Flags in AML/CFT

Red flags are warning signs that suggest a customer may be engaged in suspicious activities, such as money laundering or financing terrorism. These indicators help financial institutions take preemptive measures to mitigate risks and comply with the AMLA law. Detecting red flags early, especially during client onboarding, is essential in preventing illicit activities and maintaining the financial system's integrity.

Key Red Flags to Watch for During Client Onboarding

1. Secrecy and Evasiveness

One of the most common red flags during client onboarding is a client’s reluctance to provide necessary information. For example, if a client is evasive about their identity, source of funds, or beneficial ownership, this could indicate an attempt to hide illegal activities. The AMLA meaning includes identifying and verifying clients, and any reluctance in this process should be a cause for concern.

How to Address: Financial institutions should employ enhanced due diligence (EDD) procedures when clients exhibit secrecy. This includes asking for additional documentation and verifying information through third-party sources. The AMLC portal can be a valuable tool for cross-referencing data and checking against sanction lists.

RELATED: 921 Due Diligence

2. Unusual or Complex Ownership Structures

Clients who use complex or opaque ownership structures without a clear business rationale may attempt to conceal their assets' true nature or ownership. This could involve shell companies or trusts in jurisdictions with lax AML regulations that obscure funds' origins.

How to Address: Financial institutions should require full disclosure of ownership and control structures. They should also verify the legitimacy of these structures, using resources such as international databases or consulting with legal experts in jurisdictions where the entities are registered.

3. Frequent Changes in Legal Representatives

Another red flag is when clients frequently change their legal representatives without a legitimate reason. This behavior may indicate attempts to manipulate or obscure the legal processes involved in financial transactions, potentially to cover up money laundering or terrorism financing activities.

How to Address: Institutions should maintain a comprehensive record of all changes in client legal representation. Any unusual patterns or frequent changes should trigger a deeper investigation into the client's activities.

RELATED: How AML Compliance Technologies Are Transforming the Fight Against Financial Crime

4. Transactions That Do Not Align with the Client’s Profile

If a client’s transactions are inconsistent with their known profile or stated business activities, this could be a red flag. For example, if a low-income individual suddenly initiates large transactions or a business with no apparent ties to certain industries engages in unrelated high-value transactions, it may signal suspicious activity.

How to Address: Financial institutions should regularly update their customer profiles and monitor transactions for discrepancies. Using analytics tools to compare current transaction patterns against historical data can help identify unusual activity.

5. Unexplained Sources of Funds

Clients who cannot provide a clear or legitimate explanation for the source of their funds, particularly when these funds are from high-risk countries or entities, pose a significant AML/CFT risk.

How to Address: Implement rigorous procedures to verify the source of funds, especially for clients with international connections. This could involve requiring more detailed financial statements or conducting background checks through the AMLC portal or other reliable databases.

RELATED: President Duterte Approves National AML/CFT Strategy

6. Reluctance to Provide Information for Due Diligence

Clients who are unwilling to provide necessary documentation, such as identification or financial statements, should raise concerns. The Anti-Money Laundering Act mandates that financial institutions conduct thorough due diligence, and failure to comply with these requirements is a significant red flag.

How to Address: Incorporate automated workflows to flag accounts with incomplete documentation and establish follow-up protocols to obtain necessary information. If the client remains uncooperative, consider terminating the business relationship.

7. Multiple Bank Accounts or Frequent Transfers

Holding multiple bank accounts or frequently transferring funds between accounts, especially across borders, could indicate layering, a process in money laundering that aims to conceal the origins of illegally obtained money.

How to Address: Monitor accounts for frequent or unusual transfers. Implement transaction monitoring systems that can detect patterns consistent with money laundering or terrorist financing activities. Regular audits of account activity are also essential to detect and investigate these red flags promptly.

Enhancing AML/CFT Measures in the Philippines

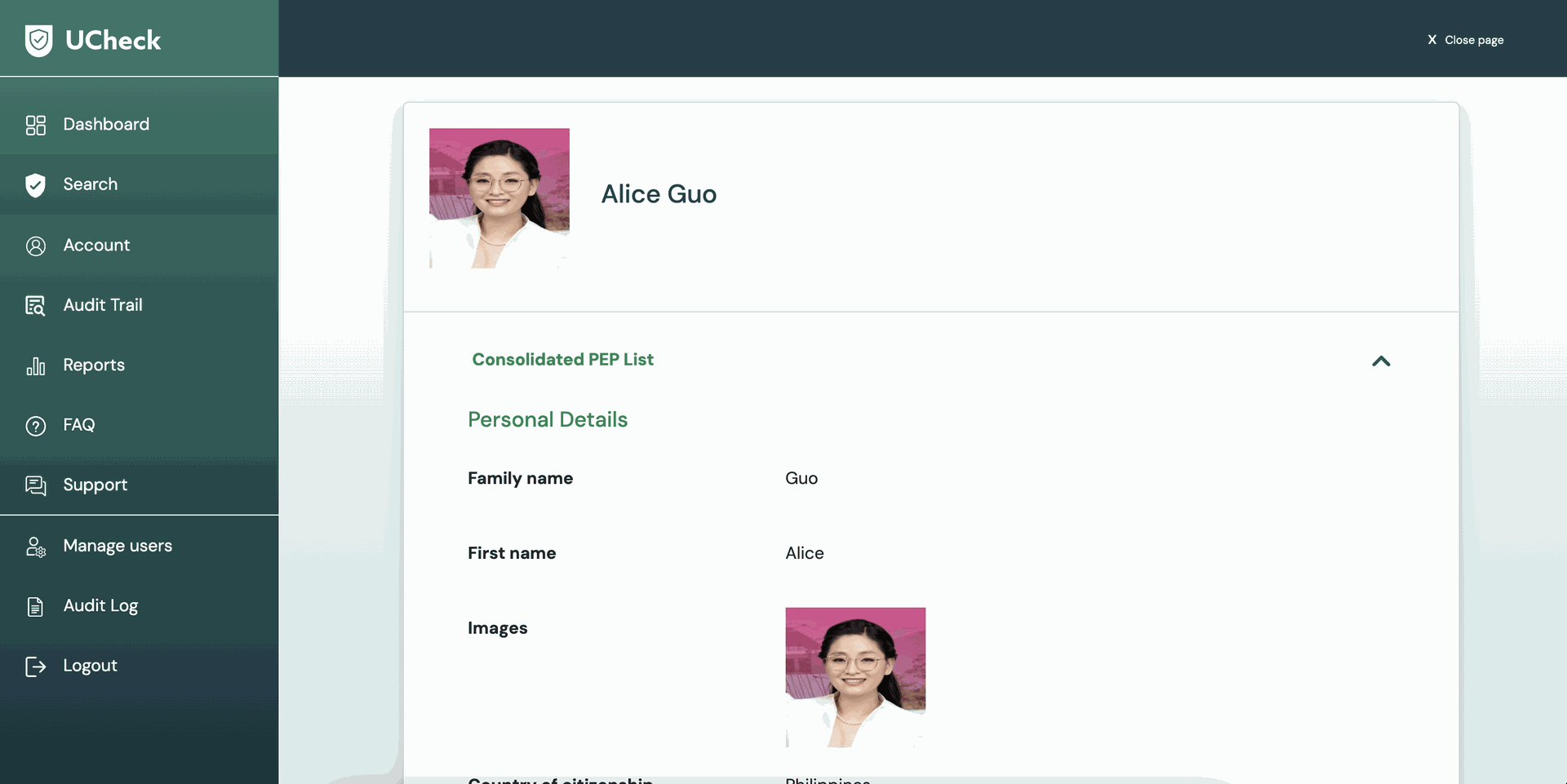

To combat financial crimes effectively, financial institutions in the Philippines must stay vigilant and adapt their AML/CFT measures to evolving threats. This includes staying updated on the latest regulations and the Terror Bill that impacts AML/CFT frameworks. Tools like UCheck are essential for real-time monitoring and reporting.

Tips for Strengthening AML/CFT Strategies:

- Regular Training and Awareness: Continuous training for staff on AML/CFT regulations, red flags, and proper reporting procedures is crucial. Staff should be aware of their obligations under the AMLA and other relevant laws, such as RA 9160.

- Utilize Advanced Analytics and Machine Learning: Implement advanced technology to analyze customer behavior and transactions. Machine learning algorithms can identify patterns that may not be immediately obvious to human analysts, allowing for more proactive risk management.

- Regular Review and Update of Policies: Ensure that your AML/CFT policies and procedures are regularly reviewed and updated to reflect current laws and industry best practices. Incorporate feedback from audits and compliance checks to improve your AML efforts continuously.

Final Thoughts

Spotting red flags during the onboarding process is crucial for effective AML/CFT compliance. Financial institutions in the Philippines must leverage tools like UCheck and advanced technologies to detect suspicious activities early. By strengthening their AML/CFT measures and staying informed about the latest regulations, such as the terror bill and RA 9160, institutions can better protect themselves from financial crimes and contribute to the overall security of the Philippine financial system.