Anti-Money Laundering (AML) compliance can be confusing, especially with evolving regulations in the Philippines. Whether you’re responsible for monitoring sanctions lists or conducting checks on politically exposed persons (PEPs), having the right tools can make all the difference. That’s where UCheck comes in.

UCheck is a comprehensive screening tool designed to help businesses comply with AML laws, including the stringent regulations for AML compliance in the Philippines, such as the Anti-Money Laundering Act (AMLA) or RA 9160. It Allows you to efficiently screen individuals and entities against international sanctions lists, PEPs, and even adverse media reports, all in one easy-to-use platform.

Let’s explore how you can use UCheck to meet your AML obligations, from sanctions checks to generating reports. Here’s a step-by-step guide to using each feature and staying compliant without the hassle.

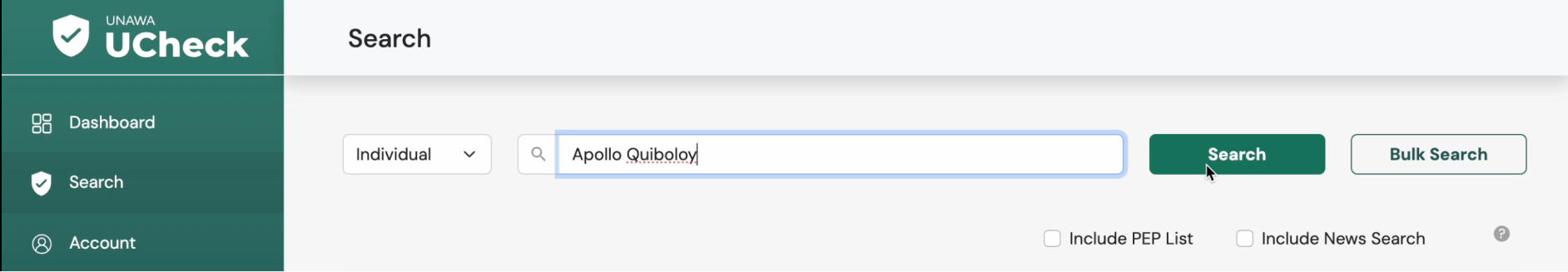

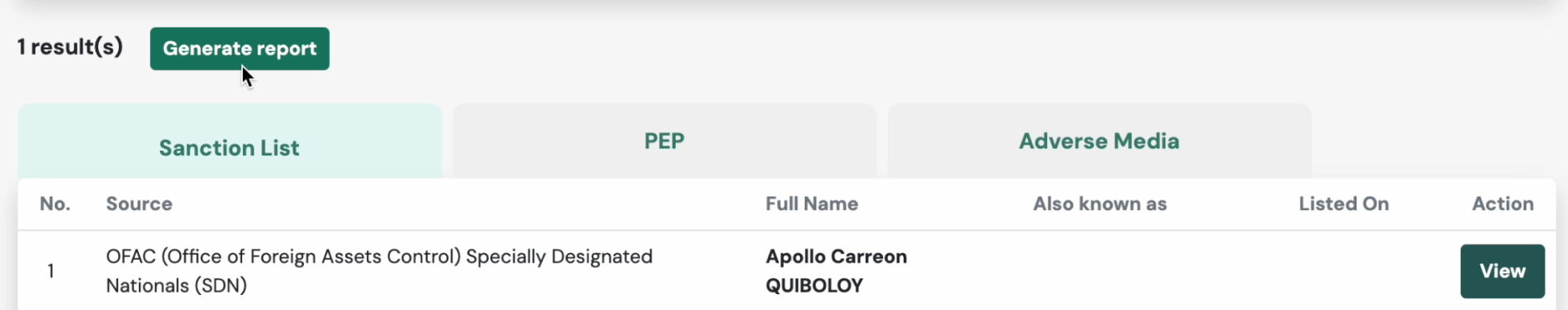

One of the cornerstones of AML compliance is screening against sanctions lists to identify individuals or organizations associated with illegal activities. This step is crucial for businesses in regulated industries, such as banks, insurance firms, and real estate companies, which are required by law to conduct thorough AML checks.

Here’s how you can use UCheck to conduct sanctions list checks quickly:

By using UCheck’s Sanctions List Check, you can confidently verify that none of your clients or business partners are linked to sanctioned entities. This greatly reduces your risk exposure and ensures that your business complies with the regulations outlined in the Anti-Money Laundering Act. This is particularly important for businesses in the Philippines to meet their AML compliance obligations under local laws.

RELATED: How FinTech’s Evolution Creates New Money Laundering Risks

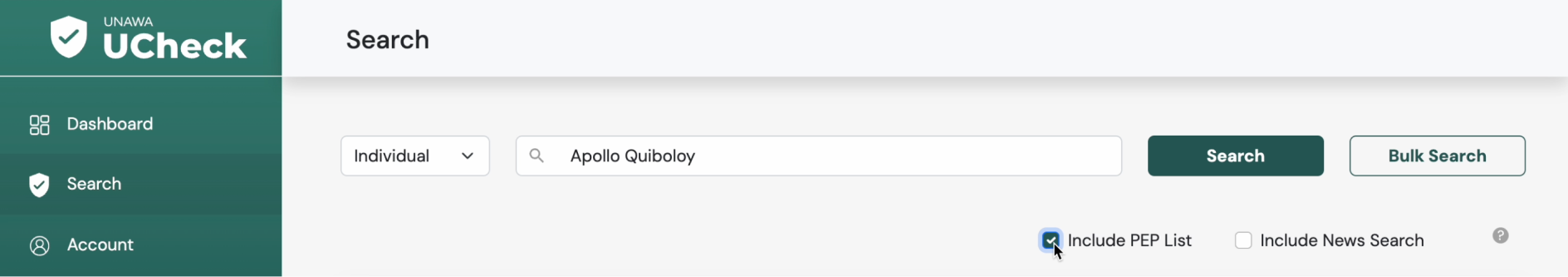

Checking for PEPs is a critical step in AML compliance, especially for businesses operating in the Philippines that need to adhere to local regulations. UCheck simplifies this process, making it easy for you to comply with AML obligations.

Here’s how to conduct a PEP check using UCheck:

Performing a PEP check helps you assess your clients’ risk levels, allowing you to make informed decisions and remain compliant with AML laws. Screening PEPs is especially important for businesses involved in high-value transactions, such as banks and investment firms, where non-compliance could lead to significant fines.

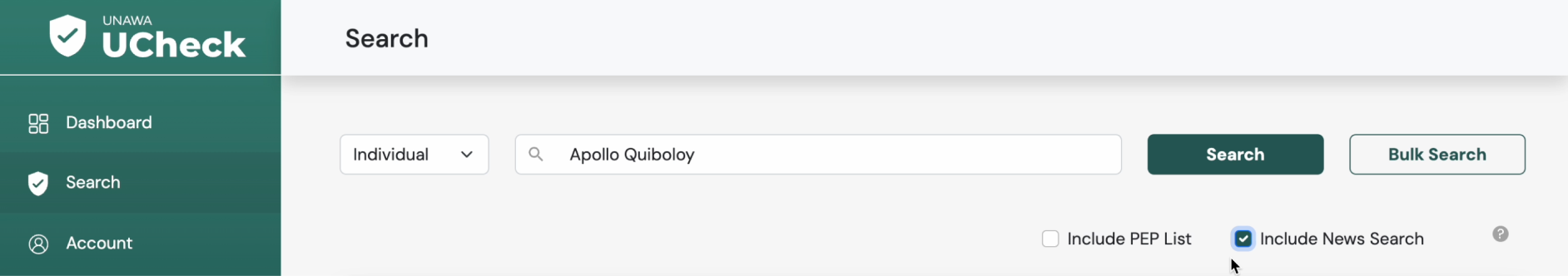

Adverse media, or negative news coverage, can provide valuable insights into the potential risks, particularly for companies in the Philippines striving for full AML compliance. Whether it’s a major scandal or allegations of wrongdoing, staying aware of this information can help you avoid costly business decisions.

Here’s how UCheck makes Adverse Media Checks quick and efficient:

With UCheck’s Adverse Media Check, you can avoid potential reputational risks and ensure your business relationships remain above board.

One of UCheck’s biggest benefits is its ability to generate comprehensive reports that prove compliance with AML regulations. These reports can be submitted directly to regulatory bodies like the Anti-Money Laundering Council (AMLC) through the AMLC portal, providing irrefutable proof that you’ve met your obligations under RA 9160.

Here’s how to generate your AML compliance reports:

These reports provide the proof of compliance you need to avoid penalties and demonstrate that your business is operating in line with the Anti-Money Laundering Act and other related laws.

UCheck simplifies the AML compliance process, allowing businesses in the Philippines to screen individuals and entities quickly and efficiently, ensuring they meet AML compliance Philippines standards. With just a few clicks, you can conduct thorough checks, generate compliance reports, and avoid the hefty penalties that come with non-compliance.

Are you ready to make AML compliance effortless? Give UCheck a try today and streamline your compliance process!