Staying compliant with Anti-Money Laundering (AML) regulations is no walk in the park. As regulations tighten and evolve, businesses are under more pressure than ever to ensure they’re not just ticking boxes but truly safeguarding against financial crimes. If you’re in a regulated industry, you already know how complex and time-consuming this can be.

But here’s the good news: while AML compliance may seem like a daunting task, the right tools can make all the difference. Enter UCheck — a solution designed to tackle the toughest AML challenges, so you can focus on what really matters: growing your business with peace of mind.

One of the biggest hurdles in AML compliance is resource capacity and capability. Hiring and training compliance officers is both time-consuming and costly, and even with a dedicated team, managing the increasing demands of AML regulations can be overwhelming. Your compliance officers are likely balancing multiple tasks, from transaction monitoring to staying updated on regulatory changes, which leaves little room for the deep dives that AML compliance often requires.

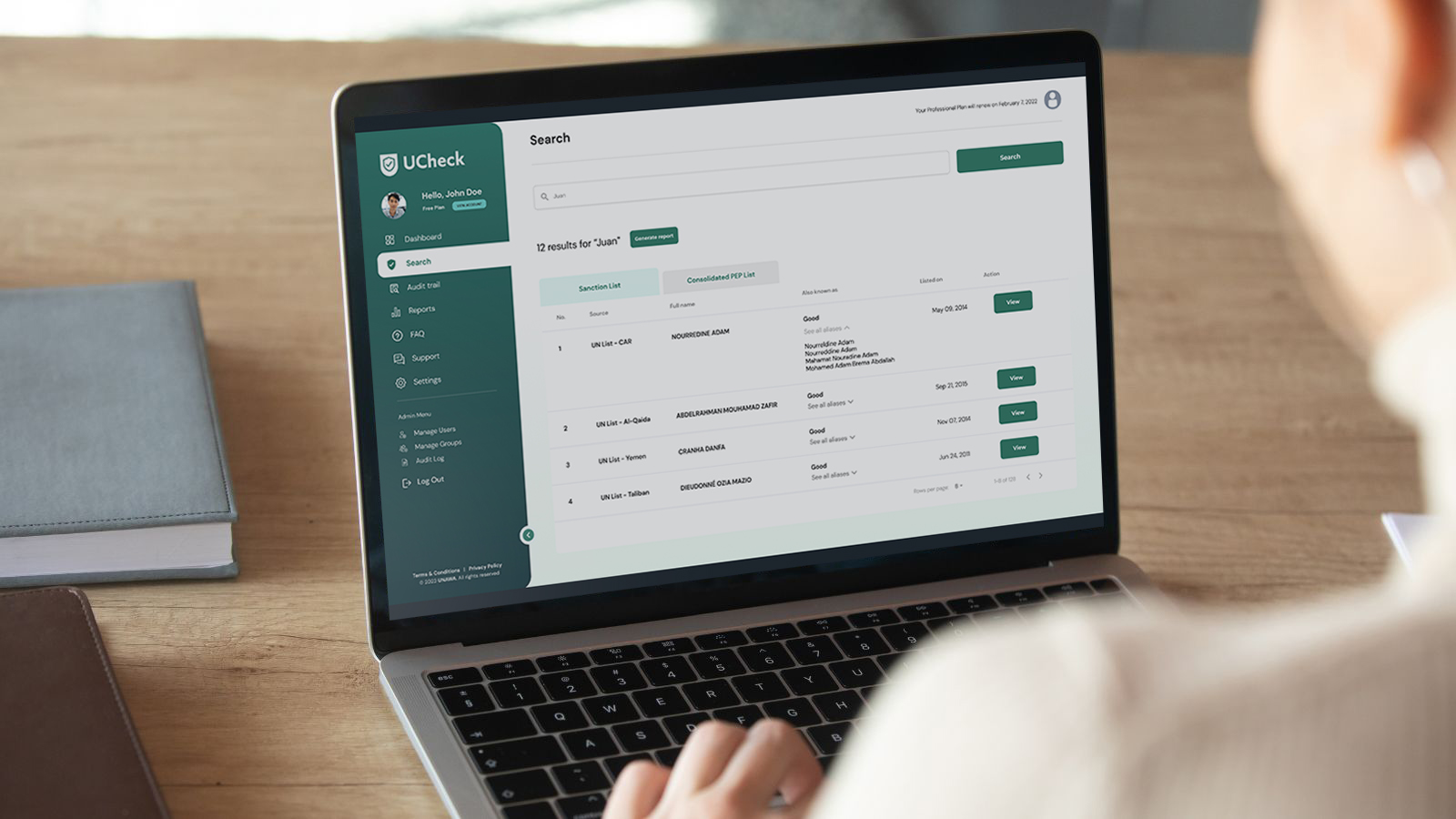

UCheck steps in as a powerful ally for your compliance team. It automates the critical aspects of AML checks, significantly reducing the need for additional staff. With UCheck, there’s no need to train extra personnel on complex AML processes because the platform does the heavy lifting. It integrates seamlessly into your existing workflow, providing a comprehensive and user-friendly dashboard where you can perform one-click searches across global sanctions lists, Politically Exposed Person (PEP) lists, and Adverse Media sources.

Another key benefit is the automated report generation feature. UCheck provides detailed, ready-to-submit reports that serve as irrefutable proof of compliance. These reports help you stay compliant with AML regulations and save your compliance officers hours of manual work, allowing them to focus on more strategic tasks.

Another major challenge in AML compliance is inefficient onboarding practices. Onboarding new clients is a critical process, but when it involves manually screening them against sanctions lists, PEP lists, and adverse media, it can quickly become a bottleneck. This slows down your operations and increases the risk of missing red flags that could lead to compliance issues down the line.

UCheck is designed to streamline the entire onboarding process. With just one click, you can conduct thorough searches across comprehensive global databases, including sanctions lists, PEP lists, and adverse media sources. This means you can vet new clients quickly and accurately, ensuring that no crucial details slip through the cracks.

What’s more, UCheck generates automated reports that provide irrefutable proof of compliance. These reports are ready to be submitted to regulatory bodies, saving you time and effort while ensuring that every onboarding is as thorough as possible. By making your onboarding process faster and more reliable, UCheck helps you stay compliant and keep your business running smoothly.

RELATED: UCheck to Counter Money Fraud in the PH

Beyond onboarding, ensuring comprehensive data coverage and accuracy is another challenge that can’t be overlooked. In the world of AML compliance, having access to the right information is everything. Incomplete or inaccurate data can leave your business vulnerable to financial crimes, and relying on outdated or limited databases just doesn’t cut it in today’s fast-paced regulatory environment.

UCheck takes the guesswork out of data accuracy by providing access to a global database for AML checks. This coverage includes the latest information from sanctions lists, PEP lists, and worldwide adverse media sources. By using UCheck, you’re tapping into a reliable and up-to-date resource that ensures your screenings are thorough and precise.

But it’s not just about the breadth of data — it’s about how easy it is to use. UCheck’s intuitive platform lets you perform detailed searches with minimal effort, delivering comprehensive and accurate results. This means you can confidently make compliance decisions, knowing that you’ve got the most current and complete information at your fingertips.

With UCheck, you can be sure that your AML compliance processes are efficient and backed by the highest data accuracy standards.

Navigating the complexities of AML compliance doesn’t have to be overwhelming. With the right tools, you can confidently tackle even the most demanding challenges. UCheck is designed to make your compliance journey smoother, more efficient, and less stressful. Whether you’re dealing with resource constraints, inefficient onboarding, or the need for accurate data, UCheck has you covered.

By integrating UCheck into your operations, you’re not just staying compliant — you’re setting your business up for long-term success. Imagine the peace of mind that comes with knowing your AML processes are solid, your data is accurate, and your compliance efforts are streamlined. That’s the power of UCheck.

Ready to simplify your AML compliance? Contact us today for a free demo and to learn more about how UCheck can transform your compliance management.