UNAWA recently participated in the 71st Rural Bankers Association of the Philippines (RBAP) Annual National Convention and General Membership Assembly, announcing a strategic partnership with EcoGlobal, a core banking solution provider. Through this collaboration, EcoGlobal has chosen to integrate UNAWA’s electronic signature, digital forms, and AMLA name screening technology into its suite of core solutions offered to rural banks. This partnership aims to streamline regulatory compliance and enhance the efficiency of rural banking operations through digital transformation.

In addition to UNAWA, other partners introduced during the event included FlexM, FinScore, and Triseed Solutions, each bringing complementary innovations to the rural banking sector.

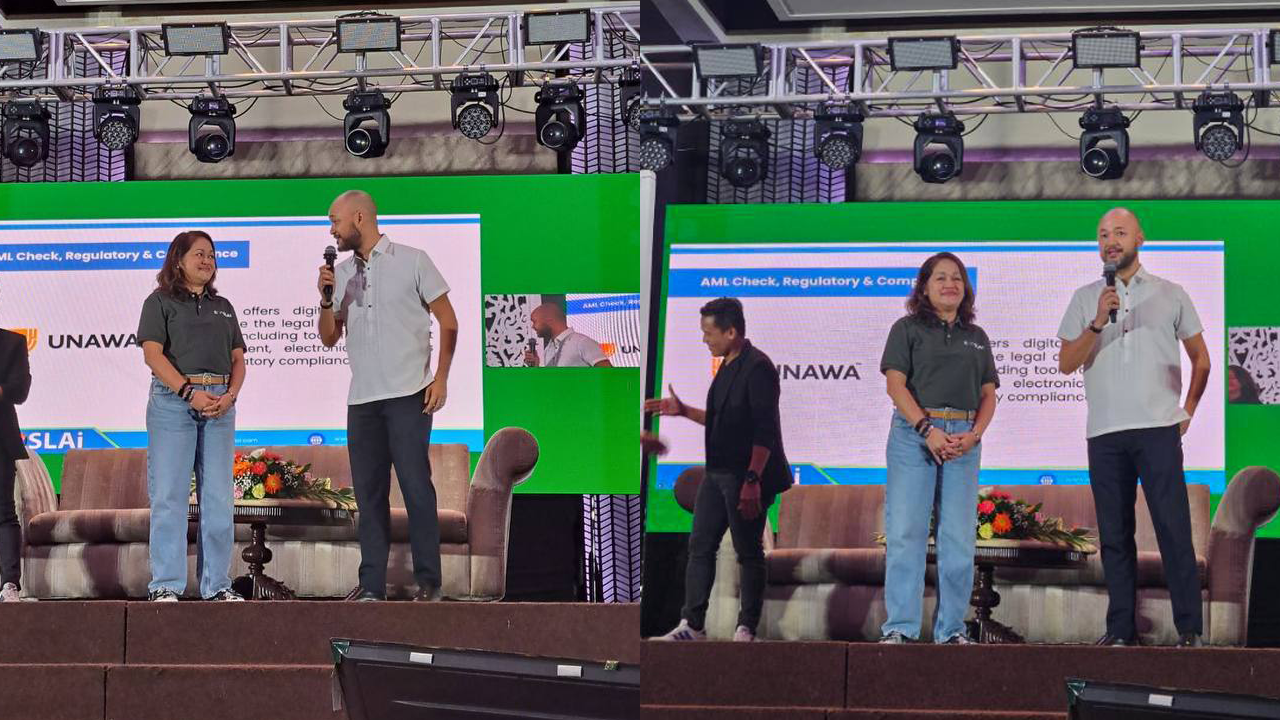

On stage, Atty. Gino Carmine de Sequera Jacinto, COO and Co-Founder of UNAWA, expressed his pride in being selected by EcoGlobal and shared his excitement about the partnership’s potential. He emphasized that this integration would enable rural banks to achieve regulatory compliance more seamlessly and accurately through automated technology, significantly reducing the risk of human error.

“Our partnership with EcoGlobal is more than just an integration of technology; it’s a commitment to uplifting rural banking by making regulatory compliance easier, faster, and more accurate,” said Atty. Jacinto. “We believe that by providing rural banks with the tools to automate and simplify compliance, we empower them to focus on their core mission—serving and growing their communities. This collaboration marks a step toward a more inclusive, digitally enabled future for rural banking in the Philippines.”

As the banking industry embraces the shift towards digital solutions, UNAWA and EcoGlobal’s alliance exemplifies a forward-thinking approach to addressing the challenges of compliance and operational efficiency. By investing in secure, reliable, and user-friendly tools, this partnership paves the way for rural banks to become more resilient and agile, positioning them for long-term growth in a rapidly evolving financial landscape.