On August 22, 2024, over 70 Subdivision and Housing Developers Association (SHDA) members gathered for a pivotal business forum where I had the opportunity to present on a critical topic: AMLA compliance in the digital age for the real estate industry. The event, attended by diverse professionals across the real estate sector, highlighted the growing importance of Anti-Money Laundering Act (AMLA) regulations. I designed my presentation to provide SHDA members with a comprehensive understanding of their challenges and responsibilities, especially as the industry faces increasing susceptibility to financial crimes due to the high-value nature of its transactions.

Money laundering is the process of disguising the origins of illegally obtained money to make it appear as though it comes from a legitimate source. This practice is not only illegal but also harmful to the global economy, as it facilitates other criminal activities like drug trafficking and terrorism. Internationally, money laundering is a significant concern, leading to the establishment global standards through organizations such as the Financial Action Task Force (FATF).

In the Philippines, the Anti-Money Laundering Act (AMLA) is the primary legislation to combat money laundering and protect the financial system from abuse. The law has undergone several amendments to enhance its effectiveness, reflecting the evolving nature of financial crimes. The Anti-Money Laundering Council (AMLC) is the key agency responsible for enforcing AMLA, monitoring financial transactions, and investigating suspicious activities.

The real estate sector, classified as a Designated Non-Financial Business and Profession (DNFBP), is particularly vulnerable to money laundering. Criminals often use real estate to launder money by purchasing properties with illicit funds. To mitigate this risk, real estate developers and brokers in the Philippines must comply with AMLA regulations, which include conducting customer due diligence and reporting suspicious activities to the AMLC.

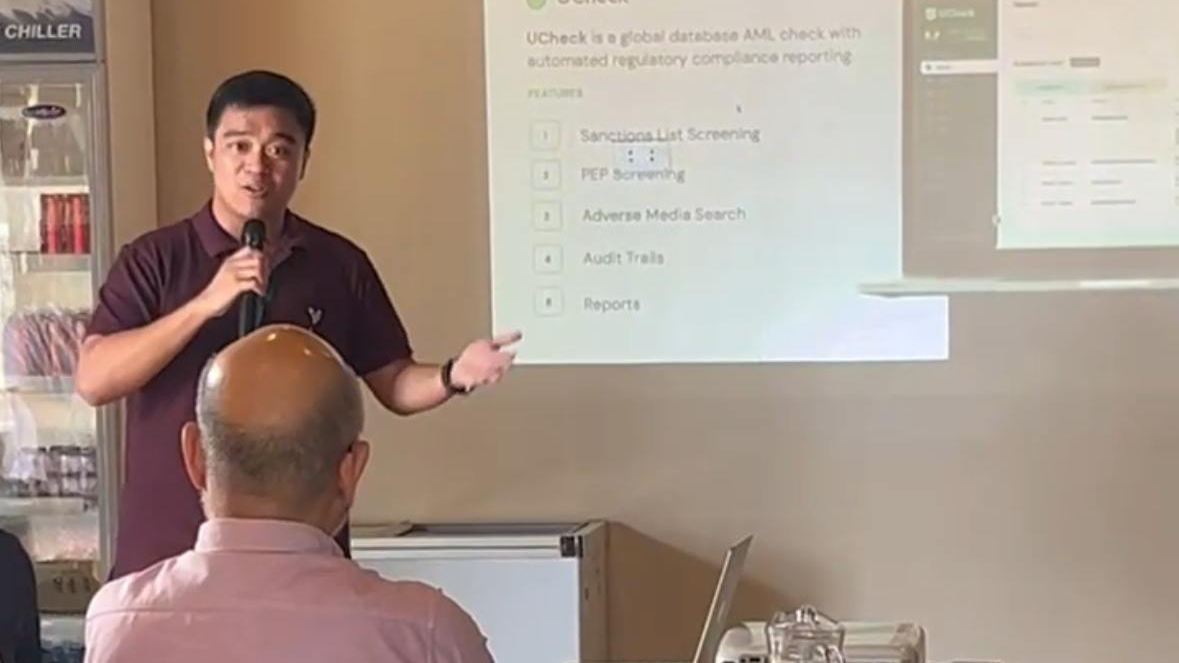

Technology has become an essential tool in AML compliance with the increasing complexity of money laundering schemes. IT solutions provide real estate companies with advanced tools for monitoring, detecting, and reporting suspicious activities. These solutions often include software systems for customer due diligence, transaction monitoring, and real-time reporting to the AMLC. Advanced analytics and machine learning allow companies to identify patterns that may indicate money laundering, making compliance efforts more effective and efficient.

The board of directors in real estate companies holds ultimate responsibility for ensuring AMLA compliance. They must establish a robust compliance framework, oversee the implementation of AML policies, and allocate adequate resources to manage AML risks. Additionally, the board plays a crucial role in fostering a culture of compliance within the organization, ensuring all employees understand the importance of adhering to AMLA regulations.

AMLA compliance is not just a legal obligation but a cornerstone of maintaining the integrity of the real estate industry. As financial crimes become more sophisticated, adopting advanced IT solutions is crucial. One such solution, UCheck, is vital in supporting AMLA compliance efforts. Streamlined for the AMLC reporting process, UCheck makes it easier for real estate developers and brokers to meet regulatory requirements. By automating customer due diligence and transaction monitoring, the real estate industry can better protect itself against money laundering threats, contributing to a safer and more transparent business environment.